No matter how big or small the size of your business is you must maintain your accounts and update the financial reports. If you neglect this dogma you can not do better in the long run.

Unfortunately, maintaining accounts according to the scientific double-entry system requires you to know the basics of accounting. Even if you know the basics, you will need to invest a lot of time to create financial reports.

This is exactly where the goodness of the WordPress ERP (a WordPress based Enterprise Resource Planning solution) comes into the play! With this accounting solution, you can not only maintain your accounts but also create the financial reports automatically and the right way even without knowing the basics of accounting.

Let’s go over and learn how to prepare & manage your journal & ledger reports with the WordPress accounting tool.

What Is Journal Report

A Journal is a detailed account that records each and every account of a transaction that happens in a business enterprise stating the date. It is the main basis of the double-entry book-keeping system. You can prepare ledger, trial balance, and other financial statements after preparing the journal very easily.

Although the journal is not the mandatory part of the double-entry system, you still should maintain it so that you can get to see the history of a transaction down the line. It can directly be used to create financial reports, for example, balance sheet, income statement, sales tax, etc.

What Is Ledger Report

The Ledger Report represents the detailed history of each account that takes place in the total life span of a business enterprise. In the WordPress ERP, you can get a complete ledger report.

The most exciting part is that you can use the filter option to create a ledger report on a specified that. You can also examine the accuracy of the ledger report from the trial balance.

How to Create Journal Entries with WordPress ERP for Free

WordPress ERP is free! The installation & activation process is similar to any WordPress plugin. Now, assuming that you have installed and activated the WordPress ERP.

Now, to create a journal entry in the WordPress ERP, there are two methods.

Method 1: For Nonaccountant

To add the journal entries, you need to analyze the debit and credit side of a transaction. But if you do not know the basics of accounting, then you should use the Sales, Purchases, and Expense options.

I would suggest you read these documentations to learn how to insert journal entries using them.

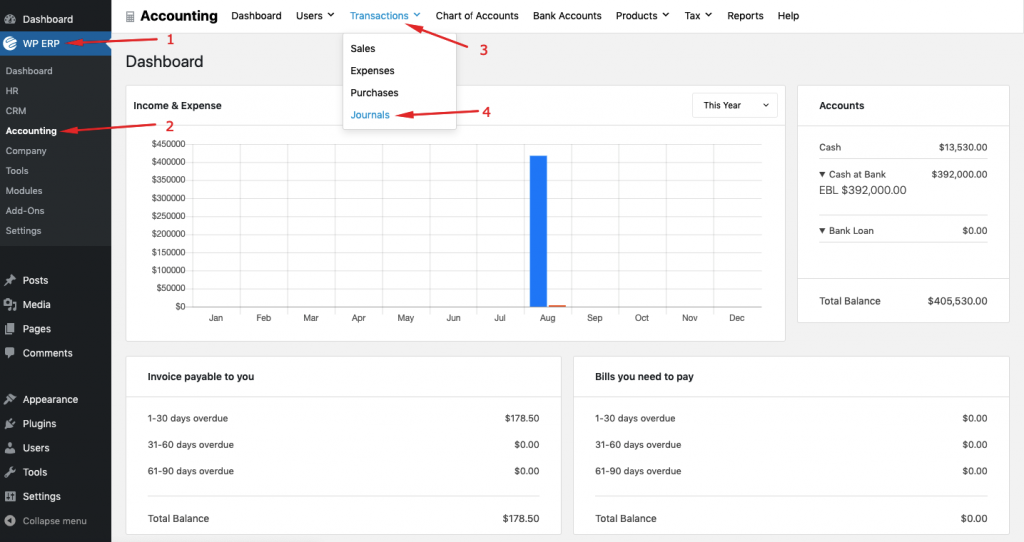

For now, I will show you how to create a journal entry with the Sales option. To do so, go to the WP Admin dashboard > WP ERP > Accounting > Transactions > Sales > New Transaction > Create Invoice.

Creating an invoice:

Now, click on the three dots to receive the payment for this invoice.

Next up, click on the “Receive Payment”

Now specifying the deposit account and payment method, save the payment:

Check this on Ledger report

Before receiving the payment we had a cash balance of 2268.20 dollars. After receiving the cash worth dollar $279.2 we are now supposed to get a new balance of ($2268.2+$279.2) = $2547.4

To check the ledger of Cash account,

- Navigate to the WP Admin Dashboard > WP ERP > Accounting > Reports > Ledger.

- Now, select the Cash account and date. Finally, hit the filter button to get to know the latest balance:

This is how you can see the latest balance which usually appears in bold style.

Method 2: For Accountant

If you do know the basics of accounting, that is, if you do know the debit and credit analysis then, you can use this option.

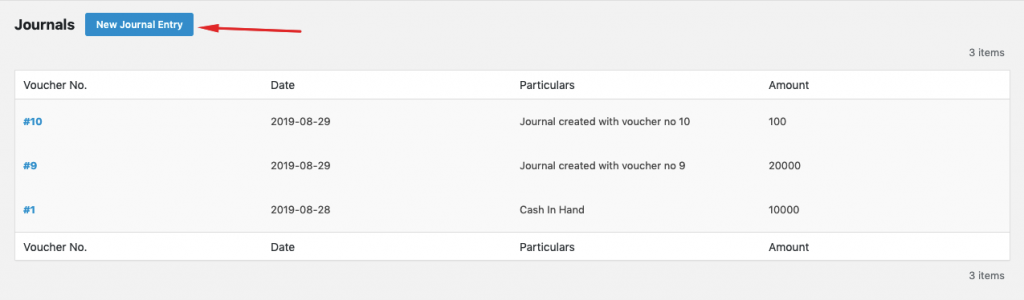

Now, click on add new journal entry:

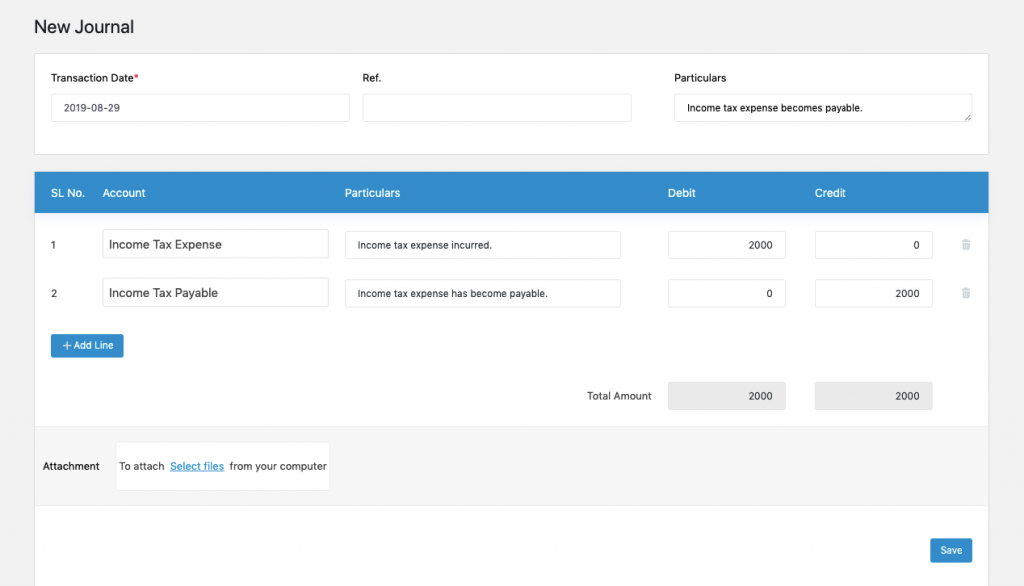

Next, insert your journal entries:

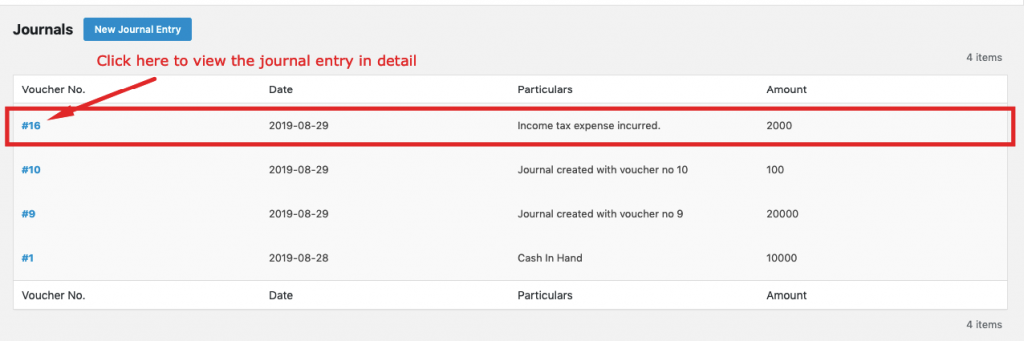

After that, you will be able to see the entry in the journal.

Now, let’s check this entry in the ledger.

Checking the Account in the ledger:

Navigate to the WP Admin Dashboard > WP ERP > Accounting > Reports > Ledger.

- Now, select the “Income Tax Expense” account and date. Finally, hit the Filter button to get to know the latest balance:

The latest balance (Here $2000) will appear in bold style.

To check the ledger balance of the “Income Tax Account”, follow the same steps. Here is the ledger balance for the “Income Tax Account”:

Note that

The Ledger balance of an account may also vary if you change that account from the opening balance.

Journal and Ledger Report: The Final Outcome

This is how you can maintain Journal entries with the WordPress accounting solution and see the Ledger reports.

Additionally, you can always see the ledger balance of an account, whether the journal entry is inserted by an accountant or nonaccountant method.

If you want to opine on the method of maintaining the Journal and Ledger report, leave your thoughts in the comment section below.